Unlocking the Power of Dark Web Monitoring for Financial Institutions

In the digital age, where financial transactions occur at the speed of light, safeguarding sensitive information has become paramount. Financial institutions are increasingly turning to dark web monitoring as a proactive measure to fortify their defenses against cyber threats.

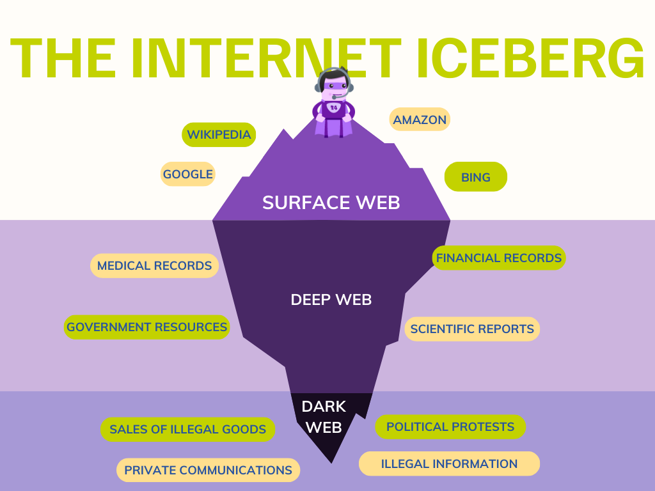

Understanding the Dark Web Landscape

The dark web is a hidden part of the internet where illicit activities often thrive. From stolen credentials to financial data, it’s a marketplace for cybercriminals. Financial institutions, aware of these lurking dangers, are investing in dark web monitoring solutions to stay one step ahead.

The Role of Dark Web Monitoring in Cybersecurity

Dark web monitoring for financial institutions involves continuous surveillance of the hidden corners of the internet where stolen data is traded. By employing advanced algorithms and AI-driven tools, institutions can detect potential threats, compromised credentials, and leaked financial information before it becomes a full-blown crisis.

Securing Customer Data and Credentials

Customer trust is the bedrock of financial institutions. Dark web monitoring plays a pivotal role in securing customer data and login credentials. By actively scanning for any signs of compromised information, institutions can take swift action to protect both their clients and their reputation.

Stay Ahead of Emerging Threats

The digital landscape is ever-evolving, and so are cyber threats. Dark web monitoring allows financial institutions to stay ahead of emerging threats by identifying new tactics and vulnerabilities exploited by cybercriminals. This proactive approach is essential in the ongoing battle against sophisticated attacks.

Compliance and Regulatory Requirements

Financial institutions operate within a framework of strict regulations and compliance standards. Dark web monitoring not only enhances security but also ensures that institutions meet regulatory requirements. By actively monitoring for potential breaches, institutions demonstrate their commitment to maintaining a secure financial ecosystem.

The Human Element in Dark Web Monitoring

Explore the nuanced world of dark web monitoring for financial institutions at rockawayuppercrust.com. In the realm of cybersecurity, technology alone is not enough. Human intelligence plays a crucial role in interpreting data, identifying patterns, and making informed decisions to thwart potential threats.

Investing in Proactive Cybersecurity

Financial institutions are shifting from reactive to proactive cybersecurity strategies. Dark web monitoring is a key investment in this proactive approach, providing real-time insights into potential risks and enabling institutions to take preventive measures before a breach occurs.

Mitigating Financial Fraud Risks

Financial fraud is a persistent threat, and the dark web is a breeding ground for stolen financial data. Dark web monitoring allows institutions to mitigate these risks by identifying compromised information and taking immediate action to prevent unauthorized access and fraudulent activities.

Collaborative Efforts in Cybersecurity

As the digital landscape becomes more complex, collaborative efforts are crucial. Financial institutions, cybersecurity experts, and law enforcement agencies must work together. Dark web monitoring serves as a bridge, providing valuable intelligence that contributes to a united front against cyber threats.

Dark Web Monitoring: A Safeguard for the Future

In a world where information is a currency, dark web monitoring is an indispensable safeguard for financial institutions. By actively monitoring and mitigating potential risks, institutions can fortify their defenses, protect customer trust, and navigate the digital landscape with confidence.